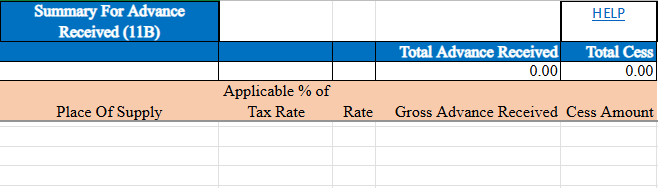

AT - Tax Liability on Advance

Under GST, tax liability on advances arises when a supplier receives an advance payment for goods or services. GST is payable on the advance amount at the applicable tax rate, even before the actual supply occurs. This ensures early revenue collection and compliance. However, this rule applies only to services; advances for goods are not subject to tax unless invoiced. Suppliers must issue a receipt voucher, mentioning the GST details. For exempt or nil-rated supplies, no tax liability is applicable. This system improves transparency, tracks transactions effectively, and ensures suppliers fulfill their tax obligations promptly.

Step by Step Procedure

1. Place of Supply (POS)

Select the correct state code for the place where the supply is considered to have occurred. This helps determine the tax jurisdiction (state GST or IGST).

2. Applicable % of Tax Rate

If the supply qualifies for a 65% reduction in the existing tax rate, select ‘65%’ from the dropdown. Otherwise, leave it blank.

3. Rate

Enter the applicable tax rate for the supply. This should include the combined state and central tax rates or the integrated tax rate (for interstate supplies).

4. Gross Advance Received

Enter the amount of advance payment received, excluding any taxes (i.e., the base amount before adding GST). This represents the value of the supply for which tax is due but has not yet been invoiced.

5. Cess Amount

If applicable, enter the total cess amount collected or payable on the advance received, in accordance with GST rules.