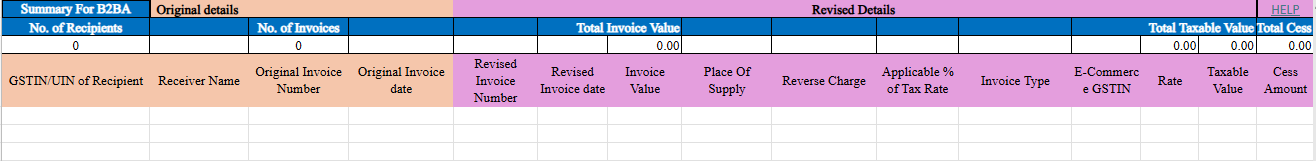

B2BA - Business-to-Business Amendment

B2BA refers to Business-to-Business Amendments under GST for supplies made to registered recipients. It involves adjusting and reporting changes in previously issued invoices to registered entities, where the tax liability was initially declared under B2B transactions. This could include corrections related to the value, tax rate, or any other details in the original document, such as credit or debit notes issued. It is essential for maintaining accurate records of taxable transactions, ensuring compliance with GST provisions, and providing the necessary amendments in the GST return for proper tax adjustments. These changes are reported to both the supplier and the recipient.

STEP BY STEP EXPLANATION:

GSTIN/UIN of Recipient:

- Enter the recipient’s GSTIN (or UIN). Ensure it’s valid on the date of the invoice.

Name of Recipient:

- Enter the name of the recipient as per their GST registration.

Original Invoice Number:

- Provide the original invoice number, formatted alphanumeric with special characters allowed.

Original Invoice Date:

- Enter the original invoice date in DD-MMM-YYYY format.

Revised Invoice Number:

- Provide the revised invoice number in the same format as the original.

Revised Invoice Date:

- Enter the revised invoice date in DD-MMM-YYYY format.

Invoice Value:

- Enter the total value of the goods or services in the invoice, with two decimal places.

Place of Supply (POS):

- Select the state code from the dropdown list to indicate the place of supply.

Reverse Charge:

- Select “Y” or “N” to indicate whether reverse charge is applicable for the supply.

Applicable % of Tax Rate:

- Select 65% if applicable; otherwise, leave blank.

Invoice Type:

- Choose the type of supply (B2B, SEZ, or deemed export) from the dropdown.

E-Commerce GSTIN:

- If the supply was made via an e-commerce operator, enter their GSTIN.

Rate:

- Enter the applicable tax rate (combined state + central tax or integrated tax).

Taxable Value:

- Enter the taxable value for each rate line item, calculated as per GST provisions.

Cess Amount:

- Enter the total cess amount collected or payable, if applicable.