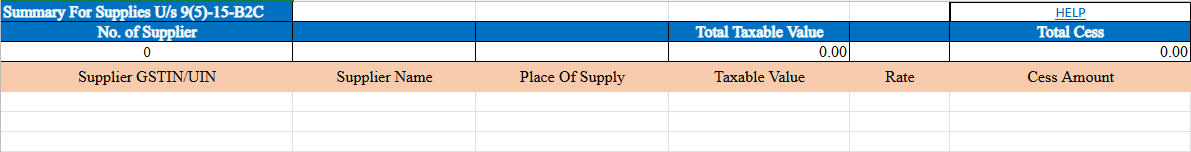

ECOB2C - E-Commerce Operator for Business-to-Consumer Transactions

ECOB2C refers to the details of supplies made to unregistered persons (B2C) under GST, where the transaction is not taxable under GST provisions or is subject to specific conditions. It captures the supply details made to end consumers, typically in the form of goods or services. These transactions are classified as B2C supplies, meaning they involve businesses selling directly to individual consumers who are not registered under GST. This process includes key data such as GSTIN, supply value, applicable tax rates, and document numbers. Correctly reporting these transactions is essential for proper GST return filing and tax compliance.

Step by Step:

-

GSTIN/UIN of Supplier:

- Enter the unique GSTIN or UIN of the supplier (e.g., 05AEJPP8087R1ZF). Ensure the registration is active on the GST portal for the document date.

-

Supplier Name:

- Enter the name of the supplier.

-

Place of Supply:

- Select the state code from the dropdown for the place where the supply was made.

-

Document Type:

- Choose from the dropdown list whether the supply is a regular B2B, deemed export, SEZ supply, or NA (Not Applicable).

-

Taxable Value:

- Enter the taxable value of the goods or services. The taxable value should be calculated based on GST valuation provisions, up to two decimal digits.

-

Rate:

- Enter the applicable GST rate (combined State tax + Central tax or integrated tax rate).

-

Cess Amount:

- Enter the cess amount that is collected or payable on the supply, if applicable.