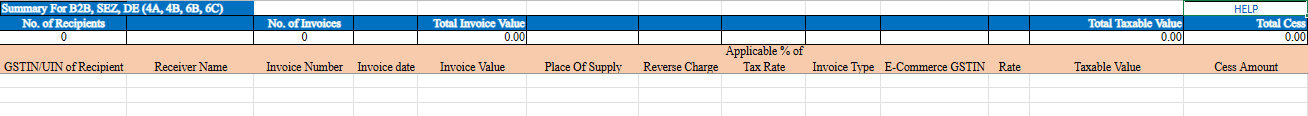

Business to Business (B2B) Transactions in GST

B2B (Business-to-Business) refers to transactions or relationships between two businesses, rather than between a business and individual consumers. In a B2B model, one business sells products or services to another business for use in their operations, production, or resale. Examples include manufacturers selling to wholesalers, or software companies providing tools to enterprises. The B2B model often involves larger transactions, longer sales cycles, and more complex relationships compared to B2C (Business-to-Consumer).

-

GSTIN/UIN of Recipient

- Enter the GSTIN or UIN of the recipient.

- Example:

05AEJPP8087R1ZF. - Ensure the GSTIN/UIN is active on the invoice date by verifying it on the GST portal.

-

Name of Recipient

- Provide the name of the recipient as registered in GST records.

-

Invoice Number

- Input the invoice number issued to the recipient.

- The format must be alphanumeric, with allowable special characters: slash (/) and dash (-).

- The total number of characters should not exceed 16.

-

Invoice Date

- Record the invoice date in the format:

DD-MMM-YYYY. - Example:

24-May-2017.

- Record the invoice date in the format:

-

Invoice Value

- Enter the total value mentioned in the invoice for the supplied goods or services.

- Use up to 2 decimal places for accuracy.

-

Place of Supply (POS)

- Choose the state code for the place of supply from the dropdown menu.

-

Applicable % of Tax Rate

- If the supply is taxed at 65% of the existing tax rate, select ‘65%’ from the dropdown menu.

- Otherwise, leave it blank.

-

Reverse Charge

- Select Y (Yes) or N (No) to indicate whether the supplies/services are taxable under the reverse charge mechanism.

-

Invoice Type

- Select the appropriate invoice type from the dropdown menu:

- Regular B2B supply.

- Supply to an SEZ unit/developer (with or without tax payment).

- Deemed export.

- Select the appropriate invoice type from the dropdown menu:

-

E-Commerce GSTIN

- Enter the GSTIN of the e-commerce operator if the supplies were made through an e-commerce platform.

-

Rate

- Enter the applicable combined tax rate (State Tax + Central Tax) or Integrated Tax.

-

Taxable Value

- Provide the taxable value of goods or services for each tax rate line item.

- Use 2 decimal places as per GST valuation provisions.

-

Cess Amount

-

Enter the total cess amount collected or payable.

-