HSN - Harmonized System of Nomenclature

HSN (Harmonized System of Nomenclature) is an internationally standardized system of names and numbers to classify goods for customs and tax purposes. In India, the HSN code is used to identify goods for GST (Goods and Services Tax) registration and filing. The HSN code helps simplify the tax system by categorizing products under specific codes. Businesses are required to mention the HSN code on invoices based on the turnover and type of goods. The HSN system ensures consistency in the classification of goods, making it easier for businesses and tax authorities to track and apply taxes efficiently.

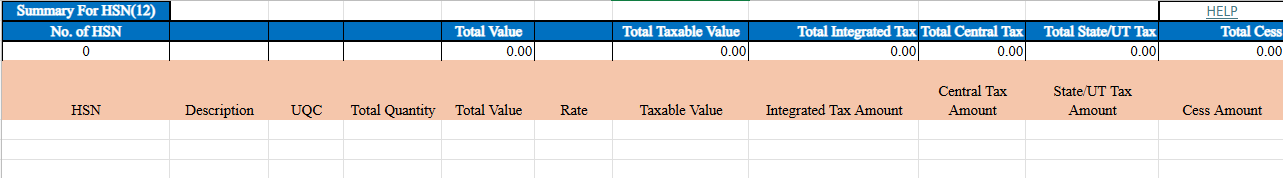

Step-by-Step Explanation:

HSN Code:

- Enter the Harmonized System of Nomenclature (HSN) code for the goods or services supplied. It’s mandatory from May’21 onwards.

Description:

- Describe the supplied goods/services. If HSN code is given, this is optional from May’21 onwards.

UQC (Unit Quantity Code):

- Select the appropriate unit of measurement for the goods or services. For services (HSN starting with 99), leave it blank.

Total Quantity:

- Enter the total quantity of the goods/services supplied. For services (HSN starting with 99), leave it blank.

Total Value:

- Enter the total value of goods/services for invoices till April’21. From May’21 onwards, this field is ignored.

Rate:

- Select the applicable tax rate (IGST, CGST, SGST, etc.) for the HSN selected. This is mandatory from May’21 onwards.

Taxable Value:

- Enter the taxable value of the supplied goods/services (up to 2 decimal digits).

Integrated Tax Amount:

- Enter the total integrated tax (IGST) amount collected or payable.

Central Tax Amount:

- Enter the total central tax (CGST) amount collected or payable.

State/UT Tax Amount:

- Enter the total state/UT tax (SGST or UTGST) amount collected or payable.

Cess Amount:

- Enter the total cess amount collected or payable for the goods/services.