ECOAB2C - E-Commerce Operator Assesses Business-to-Consumer Transactions

ECOAB2C in GST refers to transactions involving e-commerce operators (ECO) facilitating supplies to unregistered individuals (B2C). Under GST, e-commerce operators must collect and deposit tax on such supplies made through their platforms under Section 9(5) of the CGST Act. The ECO becomes liable for reporting these transactions and paying applicable GST, which includes the taxable value, GST rate, and cess (if applicable). ECOAB2C transactions must be accurately recorded, specifying the place of supply, taxable value, and GST rate to ensure compliance. Proper classification ensures transparency and accurate tax remittance by the e-commerce operator.

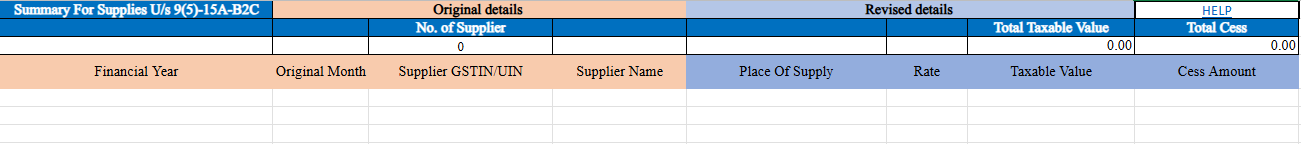

Step-by-Step Guide for Details of Amended Supplies:

Financial Year:

- Select the relevant financial year from the dropdown (e.g., 2024-2025).

Original Month:

- Choose the month in which the original transaction occurred (e.g., April).

GSTIN/UIN of Supplier:

- Enter the GSTIN or UIN of the supplier (e.g., 05AEJPP8087R1ZF).

- Ensure the GSTIN/UIN is valid and active on the transaction date by checking on the GST portal.

Supplier Name:

- Provide the supplier’s name exactly as registered under GST.

Place of Supply:

- Select the state code for the place of supply from the dropdown (e.g., TN for Tamil Nadu).

- The state code must match the supply location on the original document.

Document Type:

- Choose the type of transaction from the dropdown:

- B2B: Regular business-to-business supply.

- Deemed Export: Supplies deemed as exports under GST rules.

- SEZ Supplies: Supplies to Special Economic Zones.

- NA: For transactions not falling under any specific category.

Rate:

- Enter the applicable tax rate, combining State Tax and Central Tax, or the Integrated Tax rate (e.g., 18%).

Taxable Value:

- Specify the taxable value of the goods or services for each rate item.

- Ensure the value is computed as per GST valuation rules and includes up to two decimal digits (e.g., 10000.00).

Cess Amount:

- Enter the cess amount collected or payable, if applicable (e.g., 500.00).

- Leave blank if no cess applies to the transaction.

Final Review and Submission:

- Verify all entries for accuracy.

- Submit the amended details in the GST return portal as required.