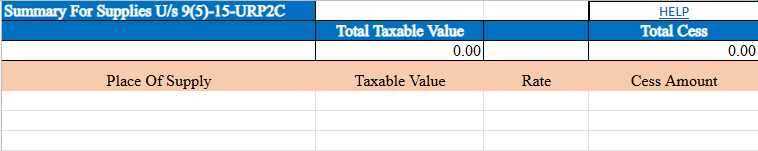

ECOURP2C - E-Commerce Operator Under Reverse Charge for Person-to-Consumer Transactions

ECOURP2C refers to the reporting of amended credit or debit notes for interstate supplies made to unregistered persons (consumers). This is governed under Section 9(5) of the GST Act. It requires details of the original and revised document numbers, dates, place of supply, taxable value, applicable tax rates, and cess amounts. The format allows adjustments to invoices exceeding specified thresholds, ensuring proper tax compliance. For instance, the taxable value must align with GST valuation rules, and the place of supply codes should match the dropdown list. Accurate data entry ensures transparency and adherence to GST provisions for unregistered consumer transactions.

Step by Step:

-

Place of Supply:

- Action: Select the code of the state from the dropdown list.

- Details: This represents the location where the supply was made, helping determine the applicable GST jurisdiction.

-

Document Type:

- Action: Choose the type of supply from the dropdown (e.g., B2B, deemed export, SEZ supply, or NA).

- Details: Select the appropriate document type based on the original supply nature.

-

Rate:

- Action: Enter the combined rate (State tax + Central tax) or integrated tax rate.

- Details: This is the tax rate that applies to the supply.

-

Taxable Value:

- Action: Enter the taxable value of the goods or services being supplied, with up to two decimal places.

- Details: The taxable value must follow GST valuation rules and reflect the actual price of the goods/services.

-

Cess Amount:

- Action: Enter the cess amount collected or payable.

- Details: Cess is an additional charge applied to specific goods/services under GST, which should be calculated separately.