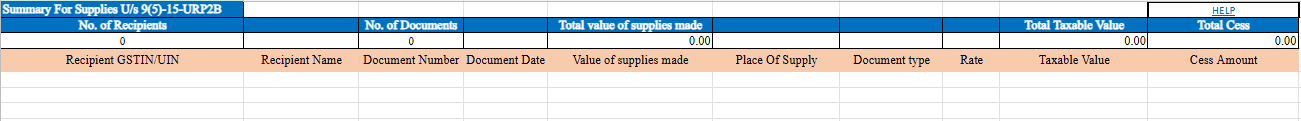

ECOURP2B - E-Commerce Operator Under Reverse Charge for Person-to-Business Transactions

The Details of Supplies U/s 9(5)-15-URP2B ensure accurate GST compliance. Enter the GSTIN/UIN of the recipient to verify their registration status, followed by their name. Provide the Document Number, maintaining a proper alphanumeric format, and the Document Date in the DD-MMM-YYYY format. Record the Total Value of Supplies, ensuring it has two decimal places. Select the Place of Supply Code from the dropdown. Specify the Document Type, applicable tax Rate, and Taxable Value for each item. Finally, input the Cess Amount, if applicable. These details ensure seamless GST compliance and error-free tax management.

Step-by-Step Guide to Filling Details of Supplies U/s 9(5)-15-URP2B

GSTIN/UIN of Recipient

- Enter the recipient’s GSTIN or UIN. Example: 05AEJPP8087R1ZF.

- Verify the registration is active on the GST portal.

Recipient Name

- Input the registered name of the recipient.

Document Number

- Enter the document number issued to the recipient.

- Follow an alphanumeric format, allowing / and -.

- Ensure the total characters do not exceed 16.

Document Date

- Record the date of the document in the format DD-MMM-YYYY. Example: 24 May 2017.

Value of Supplies Made

- Input the total value of goods or services supplied.

- Ensure values are accurate to two decimal places.

Place of Supply

- Select the state code for the place of supply from the dropdown menu.

Document Type

- You can choose the document type from the dropdown options: Regular B2B, Deemed Export, SEZ Supplies, or NA.

Rate

- Input the tax rate, combining State and Central Tax, or the Integrated Tax rate.

Taxable Value

- Calculate and enter the taxable value for goods or services per GST provisions.

- Values should be accurate to two decimal places.

Cess Amount

- Enter any applicable cess amount collected or payable.