EXEMP – Exempted

In GST, nil-rated supplies are goods or services that are taxed at a 0% rate. For example, fresh fruits and vegetables are often nil rated. Exempted supplies are goods or services that are not subject to GST, meaning they are entirely outside the scope of GST. For instance, healthcare services and education are exempted. A non-GST supplier refers to a business or individual not registered under GST, typically due to not crossing the turnover threshold required for registration. These suppliers do not charge or collect GST on their sales but may still be involved in other tax obligations.

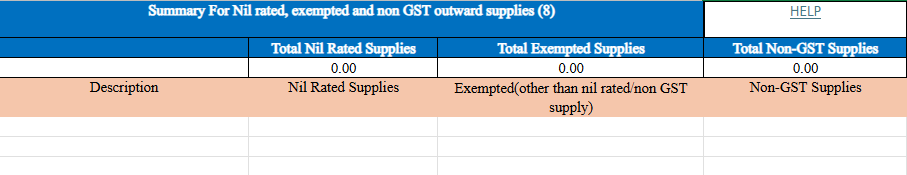

Nil Rated, Exempted, and Non-GST Supplies:

Description:

In this field, specify the type of supply you are declaring, such as goods or services, and any other necessary detail based on the category you are reporting.

Nil Rated Supplies:

This is the value of supplies made that are taxed at a 0% rate under GST. For example, certain food items may be nil-rated. Ensure the value excludes any amounts already declared in the B2B and B2CL tables of the tax invoice.

Exempted (Other than Nil Rated/Non-GST supply):

This field includes supplies that are exempt from GST. These are supplies where GST is not applicable but are outside the scope of Nil Rated or Non-GST supplies. For example, education or healthcare services.

Non-GST Supplies:

These are supplies made that are outside the scope of GST entirely, such as alcohol for human consumption or certain government services. Declare the value of these supplies in this field.