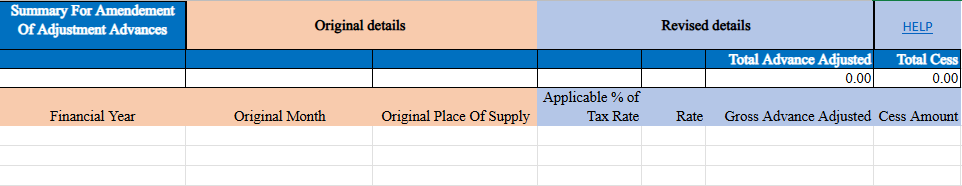

ATADJA - Advance Adjustments Amendment

Advance adjustments amendment refers to the process of modifying the value of advance payments previously made by a taxpayer, particularly in the context of Goods and Services Tax (GST). When a business receives an advance payment for goods or services to be supplied in the future, the amount is recorded in advance and taxed accordingly. If there are changes in the supply, such as cancellations, discounts, or any modification in terms, the taxpayer must adjust the previously reported tax on advances. These adjustments are reported in the GST returns to ensure accurate tax calculations and compliance with regulatory requirements.

Step by Step Explanation:

Financial Year:

Select the financial year in which the advance adjustment is being made.

Original Month:

Select the month when the original advance payment was made.

Original Place of Supply (POS):

Choose the state code where the original supply took place.

Applicable % of Tax Rate:

If the supply is eligible for taxation at 65% of the standard tax rate, select “65%” from the dropdown; otherwise, leave it blank.

Rate:

Enter the combined tax rate (State + Central tax) or the integrated tax rate applicable to the supply.

Gross Advance Adjusted:

Enter the value of the advance received in a previous tax period for which tax was already paid. This amount does not include the tax portion.

Cess Amount:

Enter the cess amount that needs to be adjusted for the advance payment.