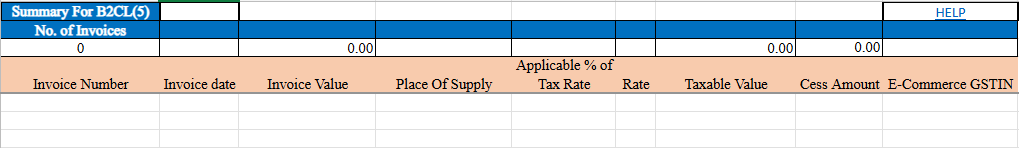

Business to Consumer Large (B2CL)

Overview

B2CL (Business to Consumer Large) refers to transactions between businesses and individual consumers. In this model, companies sell products or services directly to end customers, bypassing intermediaries. B2C is common in retail and e-commerce, where businesses like Amazon, Flipkart, or local stores offer goods directly to consumers. Examples include buying clothes online, ordering food through delivery apps, or subscribing to streaming services. The focus in B2C is on understanding consumer needs, providing excellent customer service, and leveraging marketing strategies to attract and retain individual buyers, ultimately driving sales and growth for the business.

Step-by-Step Guide for B2C Large Taxable Outward Supplies

1. Invoice Number

- Enter the invoice number issued to unregistered recipients in other states with an invoice value greater than INR 100,000 (from August 2024 onwards).

- Note: The value should be more than INR 100,000 from August 2024 onwards and more than INR 250,000 up to July 2024.

- The format must be alphanumeric with allowed special characters (slash

/and dash-). The maximum length should be 16 characters.

2. Invoice Date

- Enter the invoice date in the format:

DD-MMM-YYYY. - Example:

24 May 2017.

3. Invoice Value

- The invoice value should be more than INR 100,000 and recorded with up to two decimal places.

- Note: The value should be more than INR 100,000 from August 2024 onwards, and more than INR 250,000 up to July 2024.

4. Applicable % of Tax Rate

- If the supply is subject to 65% of the existing tax rate, select

65%from the dropdown list. - Otherwise, leave it blank.

5. Place of Supply (POS)

- Select the state code for the applicable place of supply from the dropdown menu.

6. Rate

- Enter the applicable combined tax rate (State Tax + Central Tax) or Integrated Tax, as applicable.

7. Taxable Value

- Enter the taxable value of the supplied goods or services for each rate line item.

- The taxable value should be recorded with 2 decimal digits, computed according to GST valuation provisions.

8. Cess Amount

- Enter the total Cess amount collected or payable.

9. E-Commerce GSTIN

- If the supplies are made through an e-commerce operator, enter the GSTIN of the e-commerce company.