ECOA - E-Commerce Operator – Assessed

ECOA in GSTR-1 typically relates to the scenario where the e-commerce operator is required to report the taxable supplies made by the sellers or suppliers (businesses) on their platform. The operator may also need to report on reverse charge transactions (e.g., where the e-commerce operator is responsible for collecting and remitting tax on behalf of the sellers).

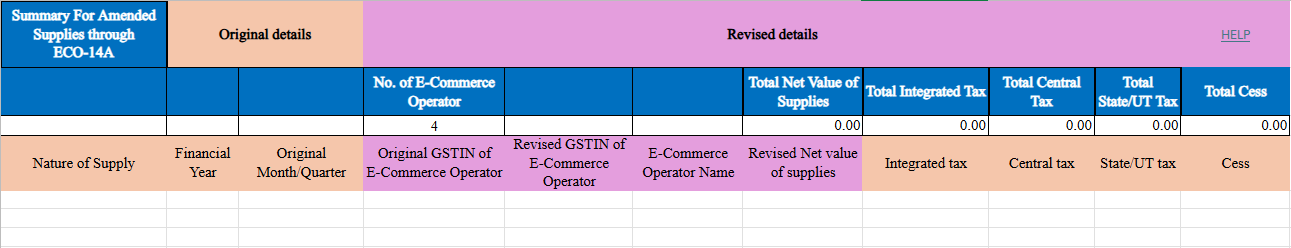

Step-by-Step Explanation:

-

Nature of Supply

Select from the dropdown the applicable nature of the supply:- Liable to collect tax u/s 52 (TCS): For supplies where the ECO collects Tax Collected at Source.

- Liable to pay tax u/s 9(5): For supplies where the ECO pays GST on behalf of the supplier.

-

Financial Year

Choose the applicable financial year from the dropdown list (e.g., 2023–2024). -

Original Month

Select the month of the original supply or transaction for which the amendment is being made. -

E-Commerce Operator GSTIN

Enter the GSTIN of the E-commerce Operator (E.g., 05ABCDE1234F1Z5).

Verify that the GSTIN is active and valid from the GST portal. -

E-Commerce Operator Name

Enter the name of the E-commerce Operator as registered in the GST portal. -

Net Value of Supplies

Enter the total value of the goods or services supplied after amendment.

Use two decimal places (e.g., ₹12,345.67). -

Integrated Tax Amount

Enter the total Integrated GST (IGST) amount collected or payable after amendment. -

Central Tax Amount

Enter the total Central GST (CGST) amount collected or payable after amendment. -

State/UT Tax Amount

Enter the total State GST (SGST) or Union Territory GST (UTGST) amount collected or payable after amendment. -

Cess Amount

Enter the total Cess amount (if applicable) collected or payable after amendment.

This step-by-step guide ensures accurate reporting of amended supplies made through an ECO, aiding compliance with GST regulations.