ECO - Electronic Commerce Operator

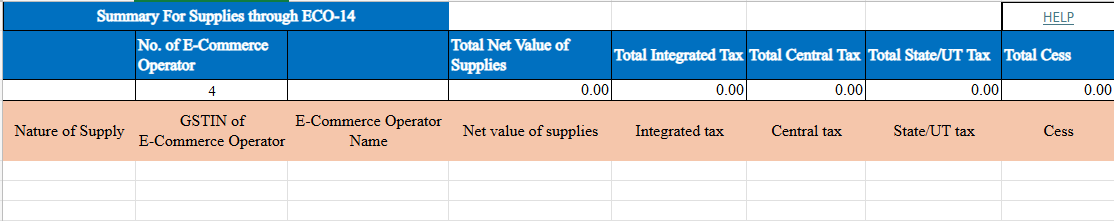

Amended supplies through an Electronic Commerce Operator (ECO) involve updating details of transactions where tax is collected or paid under specific GST provisions. The process requires selecting the nature of supply (TCS under Section 52 or tax payable under Section 9(5)) and specifying the financial year and original transaction month. Key inputs include the ECO’s GSTIN and name, the net value of supplies, and applicable tax amounts: Integrated Tax (IGST), Central Tax (CGST), State/UT Tax (SGST/UTGST), and Cess. This ensures compliance by accurately reporting changes to previously filed data and maintaining transparency in e-commerce transactions under GST regulations.

Step by Step Explanation:

-

Nature of Supply

- Select the applicable option from the dropdown:

- Liable to collect tax under Section 52 (TCS): Tax collected at source by the ECO on behalf of the seller.

- Liable to pay tax under Section 9(5): Tax payable by the ECO for specific supplies.

- Select the applicable option from the dropdown:

-

E-Commerce Operator GSTIN

- Enter the GSTIN (Goods and Services Tax Identification Number) of the ECO.

- Verify the GSTIN for accuracy and active status on the GST portal.

-

E-Commerce Operator Name

- Provide the full name of the ECO as registered with GST.

-

Net Value of Supplies

- Enter the total value of goods or services supplied through the ECO.

- Ensure the value is accurate and rounded to two decimal places.

-

Integrated Tax Amount

- Record the total IGST amount collected or payable for interstate supplies.

-

Central Tax Amount

- Enter the total CGST amount collected or payable for intrastate supplies.

-

State/UT Tax Amount

- Provide the total SGST/UTGST amount collected or payable for intrastate supplies.

-

Cess Amount

- Enter the total cess amount collected or payable, if applicable.