Export Amendment

Amended export refers to corrections or changes made to previously reported export transactions under GST. These amendments are required when errors or omissions occur in the original export details, such as invoice numbers, dates, shipping bill details, taxable values, or tax rates. Businesses must update the GST return with the revised information to ensure compliance and accurate reporting. Depending on the type of export (with or without tax payment), corrected details are filed under the respective export category (EXPWP or EXPWOP). Timely amendments help exporters claim eligible refunds or resolve discrepancies in zero-rated supply declarations for seamless tax processing.

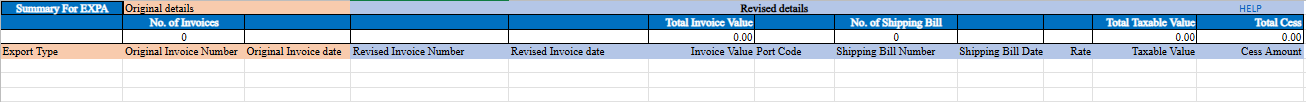

Step-by-Step Guide for Amended Export Supplies (Including SEZ/SEZ Developer or Deemed Exports)

Export Type

Determine whether the export is made with payment of tax or without payment of tax.

- Enter WPAY for export with payment of tax.

- Enter WOPAY for export without payment of tax in the respective column.

Original Invoice Number

Input the original invoice number issued to the registered receiver.

Ensure the format is alphanumeric and allows special characters like slash (/) and dash (-), with a maximum length of 16 characters.

Original Invoice Date

Provide the date of the original invoice in the format DD-MMM-YYYY (e.g., 24 May 2017).

Revised Invoice Number

If corrections are needed, enter the updated invoice number.

Follow the same format rules as the original invoice number.

Revised Invoice Date

Enter the updated date of the invoice in the format DD-MMM-YYYY (e.g., 24 May 2017).

Invoice Value

State the total invoice value of the goods or services, rounded to two decimal places.

Port Code

If exporting goods, input the six-digit port code where the export occurred.

Use the list of valid port codes provided on the GST common portal. This field is not required for the export of services.

Shipping Bill Number

Enter the unique reference number of the shipping bill.

If the shipping bill number is unavailable at the time of filing the return, leave this field blank and update it later.

Shipping Bill Date

Provide the date of the shipping bill in the format DD-MMM-YYYY.

This field can also be updated later if the information is not available during the filing. Not required for the export of services.

Applicable % of Tax Rate

If the supply qualifies for a reduced tax rate of 65% of the existing rate, select 65% from the dropdown menu.

Leave this field blank if the reduced rate is not applicable.

Rate

Input the applicable integrated tax rate (e.g., 18%, 28%) for the exported goods or services.

Taxable Value

Enter the taxable value of the goods or services for each rate line item.

Ensure the value adheres to GST valuation rules and is rounded to two decimal places.