Export

In the context of GST, export refers to the supply of goods or services to a foreign country or a Special Economic Zone (SEZ) developer/unit, where the goods or services are intended for use outside the country. The export of goods and services is treated as zero-rated under GST, meaning no tax is applied to the exported goods or services. However, businesses can claim a refund of the input tax credit (ITC) paid on inputs used for export.

Exports are categorized into two types based on the payment of tax:

- EXPWP (Export with Payment of Tax): Exports where tax is paid on the goods or services at the time of export.

- EXPWOP (Export without Payment of Tax): Exports where no tax is paid, and the goods or services are exempt from taxes at the time of export, typically under the zero-rated GST provision.

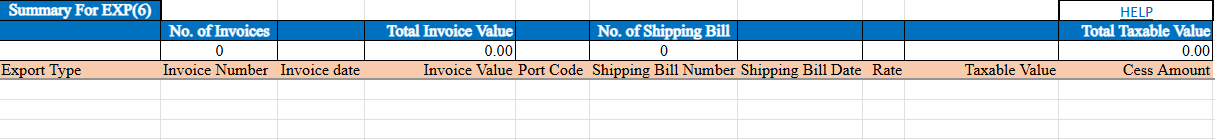

Export Supplies Including Supplies to SEZ/SEZ Developer or Deemed Exports

Step 1: Determine Export Type

Identify whether the export is with payment of tax or without payment of tax.

- Enter WPAY for “Export with Payment of Tax.”

- Enter WOPAY for “Export without Payment of Tax.”

Step 2: Enter Invoice Details

Enter the invoice number issued to the registered receiver.

- The number must be alphanumeric and can include allowed special characters like slash (/) or dash (-) with a maximum length of 16 characters.

- Record the Invoice Date in the format DD-MMM-YYYY (e.g., 24 May 2017).

Step 3: Enter Invoice Value

Input the Invoice Value of the goods or services up to two decimal digits.

Step 4: Provide Port Code

Enter the six-digit Port Code where goods were exported.

- Refer to the list of port codes available on the GST common portal.

- For services export, this field is not required.

Step 5: Add Shipping Details

- Enter the Shipping Bill Number (if available).

- If not available at the time of return filing, leave it blank and provide the information later.

- Record the Shipping Bill Date (if available).

- Leave blank if not available at the time of submission. This field is not required for services export.

Step 6: Check Tax Applicability

If the export supply is eligible for taxation at 65% of the existing tax rate, select 65% from the dropdown. Otherwise, leave the field blank.

Step 7: Enter Tax Rate

Enter the applicable Integrated Tax Rate.

Step 8: Add Taxable Value

Input the Taxable Value of goods or services up to two decimal digits for each rate line item.

Ensure the taxable value is calculated based on GST valuation provisions.

Step 9: Review and Submit

Verify all details for accuracy.

Submit the data in the relevant GST return form.