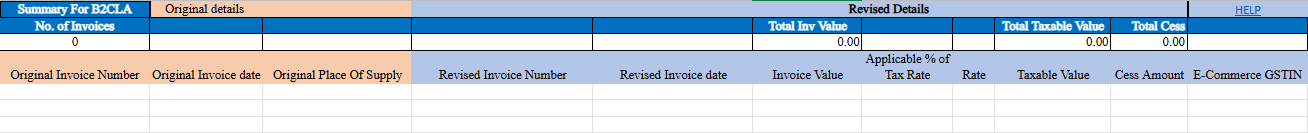

Business to Consumer Large (B2CL) Amendment

Overview

Amended B2C Large refers to updated GST filing requirements for taxable outward supplies made to consumers in different states. The key criteria are:

Businesses must report these transactions, including details such as invoice number, invoice date, place of supply, taxable value, tax rate, and cess amount. If made through an e-commerce platform, the e-commerce GSTIN is also required.

Step-by-Step Guide for Amended B2C Large Taxable Outward Supplies

1. Original Invoice Number

- Enter the original invoice number issued to an unregistered recipient in another state with an invoice value greater than INR 100,000 (from August 2024 onwards).

- Note: The value should exceed INR 100,000 from August 2024 onward, or INR 250,000 up to July 2024.

- The format should be alphanumeric with allowed special characters (slash

/and dash-), maximum length of 16 characters.

2. Original Invoice Date

- Enter the original invoice date in the format:

DD-MMM-YYYY. - Example:

24 May 2017.

3. Revised Invoice Number

- Enter the revised invoice number issued for the same transaction to an unregistered recipient with an invoice value greater than INR 100,000.

- Note: Ensure compliance with the value criteria stated above. The format should be alphanumeric with allowed special characters.

4. Revised Invoice Date

- Enter the revised invoice date in

DD-MMM-YYYYformat.

5. Invoice Value

- The invoice value should be more than INR 100,000 with up to two decimal digits.

- Note: Ensure compliance with the value criteria (more than INR 100,000 from August 2024 onwards or more than INR 250,000 up to July 2024).

6. Original Place of Supply (POS)

- Select the state code from the dropdown list for the applicable place of supply.

7. Applicable % of Tax Rate

- If the supply is taxed at 65% of the existing tax rate, select

65%from the dropdown. - If not, leave it blank.

8. Rate

- Enter the combined tax rate (State + Central tax) or the Integrated Tax rate, as applicable.

9. Taxable Value

- Enter the taxable value of the goods or services, calculated as per GST provisions, with 2 decimal digits.

10. Cess Amount

- Enter the total cess amount collected or payable.

11. E-Commerce GSTIN

- If the supplies are made through an e-commerce operator, enter the e-commerce GSTIN.