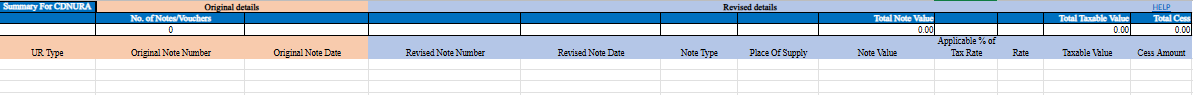

Credit / Debit Notes for Un-Registered persons Amendment

Amended credit or debit notes for unregistered persons are adjustments made to original transactions where the interstate invoice value exceeds Rs. 1 lakh (from August 2024) or Rs. 2.5 lakh (up to July 2024). These notes correct errors or modify details in the original invoices, such as taxable value, tax rates, or supply conditions. The process involves updating key information, including the original and revised note numbers, dates, type (credit, debit, or refund), taxable value, and applicable tax rates. Accurate reporting of these amendments ensures compliance with GST regulations and helps reconcile tax liabilities for supplies to unregistered persons.

Step-by-Step Process

1: Select UR Type

Choose the type of supply from the dropdown:

- EXPWP: Export with Payment of Tax

- EXPWOP: Export without Payment of Tax

- B2CL: Supplies to consumers

2: Enter the Original Note Number

Enter the original credit/debit note number.

The format must be alphanumeric with allowed characters like slash (/) and dash (-) (maximum length: 16 characters).

3: Enter the Original Note Date

Provide the date of the original note in DD-MMM-YYYY format (e.g., 24 May 2017).

4: Enter Revised Note Number

Enter the revised credit/debit note number.

Ensure it follows the same alphanumeric format as the original note number.

5: Enter Revised Note Date

Provide the date of the revised note or refund voucher in DD-MMM-YYYY format.

6: Specify Note Type

Enter the type of the note:

- D: Debit Note

- C: Credit Note

- R: Refund Voucher

7: Declare the Place of Supply

Indicate the place of supply based on the original document.

8: Enter Note Value

Input the total value of the note up to two decimal places.

9: Specify Applicable Tax Rate Percentage

If applicable, select 65% from the dropdown for supplies taxed at a reduced rate.

Leave blank if not applicable.

10: Enter Combined Tax Rate

Record the combined Integrated Tax (IGST) or the sum of State Tax + Central Tax (SGST + CGST) rate.

11: Enter Taxable Value

Enter the taxable value of goods/services for each rate line item up to two decimal places.

Ensure the taxable value adheres to GST valuation rules.

12: Add Cess Amount

Enter the total Cess amount if applicable.