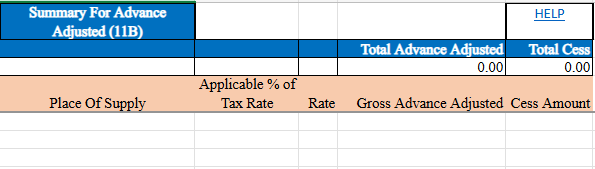

ATADJ - Advance Adjustment

Advance adjustment in GST refers to the process where the tax liability is adjusted for any advance payments received, but for which invoices have not yet been issued. This typically occurs when goods or services are supplied, and the supplier has already received payment, but the invoice will be issued in a future period. The adjustment allows the supplier to account for the tax on the advance received, ensuring that the tax liability is updated correctly in the return period. The advance payment amount, along with any applicable tax and cess, is recorded for proper reconciliation in subsequent invoices.

Step-by-Step Advance Adjustments

1. Place of Supply (POS)

Select the code of the state where the goods or services are supplied. This will determine the applicable GST rate.

2. Applicable % of Tax Rate

If the supply is eligible to be taxed at 65% of the existing tax rate, select ‘65%’ from the dropdown list. Otherwise, leave this blank.

3. Rate

Enter the combined tax rate (State + Central tax) or integrated tax rate (for interstate supplies) applicable to the supply.

4. Gross Advance Adjusted

Enter the amount of the advance on which tax was already paid in a previous tax period, excluding the tax portion. This is the amount to be adjusted against the current tax liability.

5. Cess Amount

Enter the total Cess amount that needs to be adjusted for the advance payment received earlier.