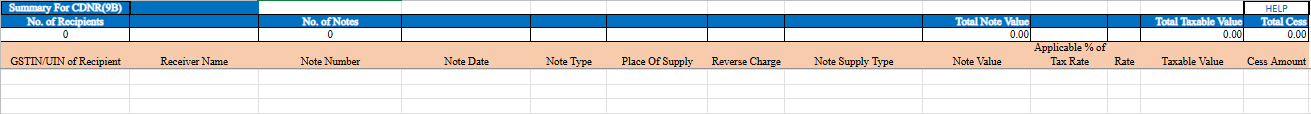

Credit and Debit Notes Registered (CDNR)

Credit and debit notes are used to amend or adjust previously issued invoices.

Credit Note

Issued when a seller needs to reduce the amount due from the buyer, often due to returned goods, overbilling, or discounts. It effectively decreases the buyer’s payable amount.

Debit Note

Issued when a seller needs to increase the amount due from the buyer, typically for underbilling or additional charges. It increases the buyer’s payable amount.

Both documents are crucial for ensuring accurate accounting and GST reporting, with details such as invoice numbers, tax rates, and amounts adjusted.

1. GSTIN/UIN

- Enter the GSTIN or UIN of the recipient (registered taxpayer).

2. Name of Recipient

- Enter the full name of the recipient.

3. Note Number

- Enter the credit/debit note number in an alphanumeric format (maximum 16 characters). Allowed special characters: slash (/) and dash (-).

4. Note Date

- Enter the date of the credit/debit note in DD-MMM-YYYY format. Example: 24-May-2017.

5. Note Type

- Select the type of note:

"D"for Debit note"C"for Credit note"R"for Refund voucher

6. Place of Supply

- Select the place of supply code based on the original document.

7. Reverse Charge

- Select

"Y"if the supplies/services are subject to the reverse charge mechanism; otherwise select"N".

8. Note Supply Type

- Choose the supply type from the dropdown:

- Regular B2B

- SEZ unit/developer (with or without payment of tax)

- Deemed export

9. Note Value

- Enter the value of the note, with up to two decimal digits.

10. Applicable % of Tax Rate

- If the supply is taxed at 65% of the existing rate, select

'65%'from the dropdown. If not, leave it blank.

11. Rate

- Enter the applicable tax rate (combined State and Central Tax, or Integrated Tax).

12. Taxable Value

- Enter the taxable value of the supplied goods/services, computed as per GST valuation provisions, with two decimal digits.

13. Cess Amount

- Enter the total Cess amount, if applicable.