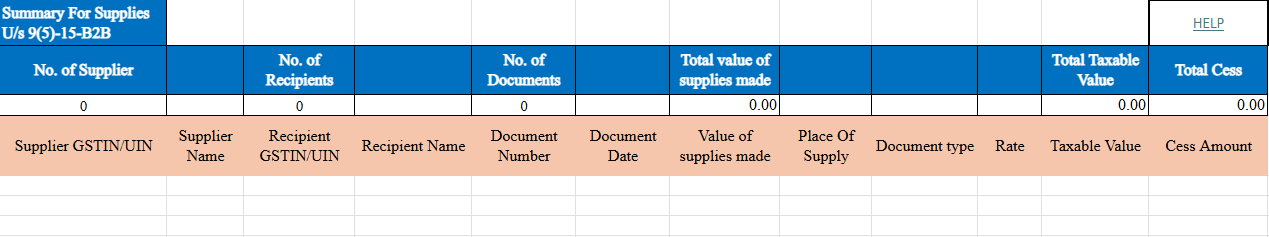

ECOB2B - E-Commerce Operator Business to Business Transactions

ECO B2B, or E-Commerce Operator for Business-to-Business transactions, refers to a framework where an e-commerce platform facilitates the supply of goods or services between businesses under GST regulations. The operator is responsible for collecting and reporting tax on supplies made via their platform under Section 9(5) of the CGST Act. Businesses must provide accurate details, including recipient GSTIN, document details, taxable value, tax rate, and place of supply, ensuring compliance. ECO B2B simplifies tax reporting, streamlines transactions, and reduces compliance risks, ensuring transparency and efficiency in inter-business e-commerce operations.

Step-by-Step Explanation:

GSTIN/UIN of Supplier

- Enter the GSTIN or UIN of the supplier.

- Example: 05AEJPP8087R1ZF.

- Verify the GSTIN/UIN’s active status on the GST portal on the document’s date.

Supplier Name

- Enter the full name of the supplier as registered on the GST portal.

GSTIN/UIN of Recipient

- Provide the GSTIN or UIN of the recipient (buyer).

- Example: 05AEJPP8087R1ZF.

- Confirm that the GSTIN/UIN is active on the GST portal on the document’s date.

Recipient Name

- Enter the recipient’s full name as registered in the GST database.

Document Number

- Input the unique document number issued to the recipient.

- Format: Alpha-numeric with special characters like slash (/) and dash (-).

- The total length should not exceed 16 characters.

Document Date

- Record the document date in the format DD-MMM-YYYY.

- Example: 24-May-2017.

Value of Supplies Made

- Enter the total value of goods or services supplied as per the document.

- Ensure the value includes 2 decimal places (e.g., 1250.75).

Place of Supply

- Select the state code of the supply location from the dropdown list provided.

- Ensure accuracy as per GST rules.

Document Type

- Choose the appropriate document type from the dropdown menu:

- Regular B2B

- Deemed Export

- SEZ Supplies

- NA (if not applicable).

Rate

- Enter the applicable tax rate, which includes:

- State Tax

- Central Tax

- Integrated Tax.

Taxable Value

- Calculate the taxable value for each line item.

- Follow GST valuation provisions and include 2 decimal digits (e.g., 1000.50).

Cess Amount

- Provide the cess amount applicable to the transaction, if any.