ECOAB2B - E-Commerce Operator Assesses Business-to-Business Transactions

ECOAB2B refers to amended Business-to-Business (B2B) transactions under GST. It involves updating details of previously reported supplies to registered recipients, including changes in invoice numbers, dates, taxable value, tax rate, and cess amount. These amendments ensure accurate tax compliance and reporting. This category includes corrections for invoices issued to GST-registered businesses, maintaining alignment with GST rules and valuation provisions.

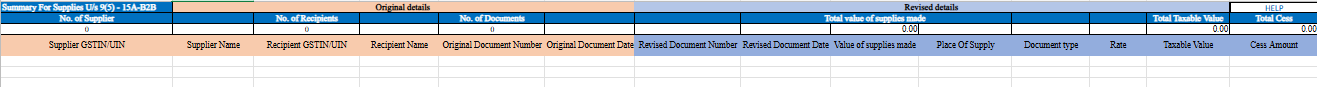

Step-by-Step Guide:

GSTIN/UIN of Supplier

- Locate and enter the supplier’s GSTIN or UIN (e.g., 05AEJPP8087R1ZF).

- Verify that the supplier’s registration is active using the GST portal.

Supplier Name

- Enter the full name of the supplier as per GST records.

GSTIN/UIN of Recipient

- Locate and enter the GSTIN or UIN of the recipient.

- Verify that the recipient’s registration is active using the GST portal.

Recipient Name

- Enter the full name of the recipient as per GST records.

Original Document Number

- Provide the original document number (credit or debit note).

- Ensure it is alpha-numeric, allowing characters like slash (/) or dash (-), with a maximum of 16 characters.

Original Document Date

- Enter the original document’s date in the format DD-MMM-YYYY (e.g., 24-May-2017).

Revised Document Number

- Enter the revised document number using the same format as the original.

Revised Document Date

- Enter the revised document’s date in the format DD-MMM-YYYY.

Value of Supplies Made

- Input the total value of goods or services supplied as per the invoice, up to two decimal digits.

Place of Supply

- Select the state code for the place of supply from the dropdown list (e.g., TN for Tamil Nadu).

Document Type

- Choose the document type from the dropdown options:

- Regular B2B

- Deemed Export

- SEZ Supplies

- NA

Rate

- Enter the combined tax rate (State Tax + Central Tax) or the Integrated Tax Rate applicable.

Taxable Value

- Compute and enter the taxable value of goods or services for each rate line item, up to two decimal digits, following GST valuation provisions.

Cess Amount

- Input the total cess amount collected or payable, if applicable.

Verification

- Double-check all details entered for accuracy before submitting.