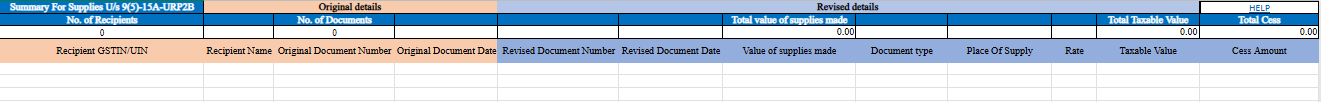

ECOAURP2B - E-Commerce Operator Assesses Under Reverse Charge for Person-to-Business Transactions

ECOAURP2B refers to transactions under GST involving e-commerce operators for supplies made to unregistered persons. These transactions fall under Section 9(5) of the GST Act, where the e-commerce operator is liable to collect and pay GST on behalf of the supplier. This category includes interstate supplies of goods or services to unregistered individuals. Key details like the financial year, original transaction month, place of supply, tax rate, taxable value, and any cess amount need to be declared while filing returns. ECOAURP2B ensures transparency and compliance for e-commerce operators managing such supplies under GST regulations.

Step-by-Step Guide:

GSTIN/UIN of Recipient:

- Obtain the GSTIN or UIN of the recipient.

- Validate the registration status of the GSTIN/UIN on the GST portal.

Recipient Name:

- Enter the recipient’s full name as per the GST registration details.

Original Document Number:

- Input the original document number.

- Ensure the format is alphanumeric with allowed special characters like slash (/) and dash (-), with a maximum of 16 characters.

Original Document Date:

- Provide the date of the original document in DD-MMM-YYYY format (e.g., 24 May 2017).

Revised Document Number:

- Enter the revised document number.

- Follow the same format rules as the original document number.

Revised Document Date:

- Input the revised document date in DD-MMM-YYYY format.

Value of Supplies Made:

- Record the total invoice value of the goods or services supplied, up to 2 decimal places.

Place of Supply:

- Select the state code from the dropdown list representing the place of supply.

Document Type:

- Choose the document type from the dropdown:

- Regular B2B

- Deemed Export

- SEZ Supplies

- NA

Rate:

- Enter the applicable tax rate, which is the combined value of state and central tax or the integrated tax rate.

Taxable Value:

- Specify the taxable value of each line item in the supply, calculated up to 2 decimal places, following GST valuation provisions.

Cess Amount:

- Declare the cess amount collected or payable for the transaction.