Docs – Documents

This section involves reporting details of supplies through an Electronic Commerce Operator (ECO). Key steps include selecting the nature of supply (TCS or under Section 9(5)), providing the ECO’s GSTIN and name, and entering the net value of supplies, tax amounts (IGST, CGST, SGST/UTGST), and cess amounts. These details must be accurate and in line with GST regulations to ensure proper tax compliance and reporting.

Step by Step Explanation:

-

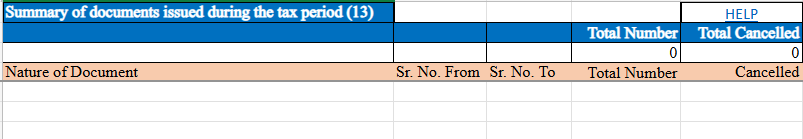

Nature of Document:

- Select the applicable document type from the dropdown (e.g., invoice, credit note, debit note, etc.).

-

Sr. No From:

- Enter the starting number of the document series. This is the first number in your invoice or document range.

-

Sr. No To:

- Enter the ending number of the document series. This is the last number in your invoice or document range.

-

Total Number:

- Enter the total count of documents issued within the specified series.

-

Cancelled:

- Enter the number of documents that were cancelled within this document series during the tax period.