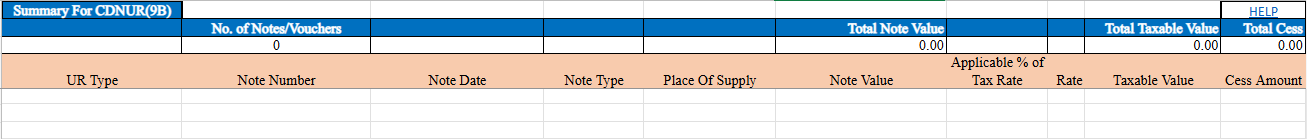

Credit and Debit Notes Un-Registered (CDNUR)

Credit and debit notes for unregistered persons refer to adjustments made for supplies to individuals or entities not registered under GST. These notes are issued when there is a change in the value or details of a supply, such as a return, discount, or overcharging. A credit note reduces the tax liability and the value of the supply, while a debit note increases the value of the supply and tax liability. These adjustments must be reported, and the correct GSTIN or UIN of the unregistered person is not required. It ensures accurate reporting of transactions for tax purposes.

Step-by-Step Guide:

UR Type

- Select the type of supply made to unregistered persons (UR) from the dropdown:

"EXPWP"for export with payment."EXPWOP"for export without payment."B2CL"for supplies to consumers.

Note Number

- Enter the credit or debit note number. It must be in an alphanumeric format and can include special characters such as slashes (/) or dashes (-), with a maximum length of 16 characters.

Note Date

- Enter the date of the credit or debit note in the format DD-MMM-YYYY (e.g., 24-May-2017).

Note Type

- Select the type of note:

"D"for Debit Note."C"for Credit Note."R"for Refund Voucher.

Place of Supply

- Select the place of supply from the dropdown based on the original document (this refers to the state from which the goods/services are supplied).

Note Value

- Enter the value of the note up to two decimal digits.

Applicable % of Tax Rate

- If the supply is eligible for a reduced tax rate of 65%, select

'65%'from the dropdown. Otherwise, leave it blank.

Rate

- Enter the combined rate of tax (State + Central tax) or Integrated tax rate applicable to the transaction.

Taxable Value

- Enter the taxable value of the goods or services, calculated as per GST valuation provisions, with up to two decimal places.

Cess Amount

- Enter the total cess amount payable, if applicable.