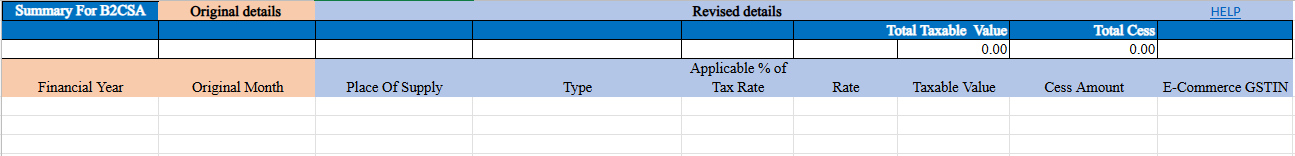

Business to Consumer Small (B2CS) Amendment

Amended B2C Small refers to corrections or changes made to previously reported B2C Small transactions. These amendments are necessary when the original details, such as the invoice number, date, or value, require updating. The supply could be intra-state (any value) or inter-state (invoice value ≤ INR 1.0 lakh from August 2024, or ≤ INR 2.5 lakh up to July 2024). Businesses need to report the original and revised invoice numbers, dates, taxable value, applicable tax rate, cess amounts, and e-commerce GSTIN if applicable. These amendments ensure accurate reporting and compliance with updated GST guidelines.

Type

- Enter

"E"if the supply is made through an e-commerce platform. - Enter

"OE"for other than e-commerce.

Financial Year

- Select the applicable financial year.

Original Month

- Choose the month for the original invoice.

Original Place of Supply (POS)

- Select the state code for the original place of supply.

Revised Place of Supply (POS)

- Select the state code for the revised place of supply (if applicable).

Applicable % of Tax Rate

- If applicable, select

"65%"from the dropdown; leave blank if not.

Original Rate

- Enter the combined (State tax + Central tax) or Integrated tax rate.

Taxable Value

- Enter the taxable value of the supplied goods or services, up to 2 decimal places, computed as per GST provisions.

Cess Amount

- Enter the total cess amount collected or payable.

E-Commerce GSTIN

- Enter the GSTIN of the e-commerce operator if the supply is made through an e-commerce platform.