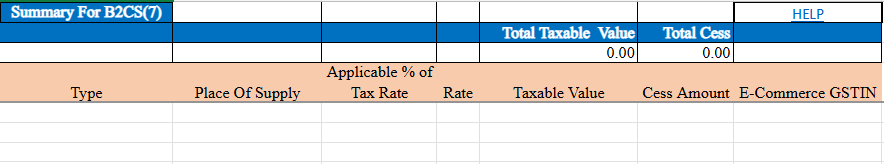

Business to Consumer Small (B2C Small)

Overview

B2C Small refers to taxable outward supplies made by a registered supplier to unregistered consumers within the same state, where the invoice value is less than INR 100,000. These transactions involve lower-value supplies compared to B2C Large. Key details to report include the invoice number, invoice date, taxable value, applicable tax rate, and place of supply (same state). Businesses are required to file these transactions in GST returns, ensuring proper tax compliance. B2C Small transactions help simplify GST reporting for smaller, intra-state sales, providing a streamlined approach for low-value supplies.

B2C Small Supplies - Step-by-Step Reporting Format

1. Type

- Enter

"E"if the supply is made through an E-Commerce platform, or"OE"if made through other means.

2. Place of Supply (POS)

- Select the state code from the dropdown for the applicable place of supply.

3. Applicable % of Tax Rate

- If the supply is taxed at 65% of the current rate, select

"65%"from the dropdown; otherwise, leave it blank.

4. Rate

- Enter the applicable combined State and Central Tax rate or Integrated Tax rate.

5. Taxable Value

- Enter the taxable value of the goods or services with 2 decimal digits, computed as per GST valuation rules.

6. Cess Amount

- Enter the total cess amount collected or payable.

7. E-Commerce GSTIN

- Enter the GSTIN of the e-commerce operator, if applicable.